- 01/27

- 2006

-

QQ扫一扫

-

Vision小助手

(CMVU)

COGNEX CORPORATION ANNOUNCES FOURTH QUARTER RESULTS

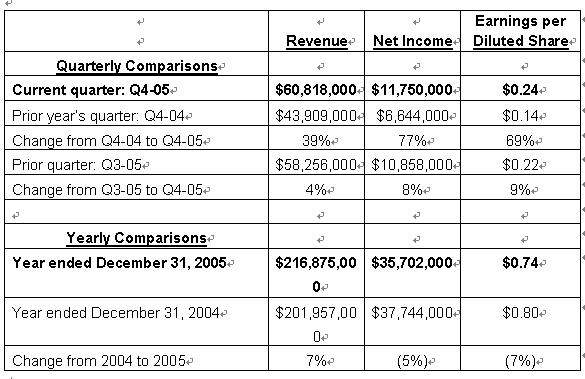

Cognex Corporation (NASDAQ: CGNX) today announced revenue for the fourth quarter ended December 31, 2005 of $60,818,000, and net income of $11,750,000, or $0.24 per diluted share. These most recent quarterly results are compared to the company’s historical results for the fourth quarter of 2004 and for the third quarter of 2005 in the table below. Also provided in the table below are revenue, net income and earnings per share for the year ended December 31, 2005, as compared to the company’s historical results for the year ended December 31, 2004.

The company’s reported results for 2005 include the results of DVT Corporation (since May 9, 2005), and also include the amortization costs related to that acquisition ($1,143,000 in the fourth quarter and $3,048,000 for the year).

“I am rather pleased with our results for 2005; despite a dramatic year-on-year decline of more than 30% in revenue from our customers who manufacture capital equipment for the semiconductor and electronics industries, our revenue kept pace with 2004 because of significant growth in our other businesses that focus on the factory floor,” said Dr. Robert J. Shillman, Cognex’s Chairman and Chief Executive Officer. “Our 2005 revenue from the Surface Inspection market grew by 22% vs. 2004, as did our business in the Factory Automation market…and that’s without including the revenue from DVT which we acquired in May of 2005. We expect that those businesses, together with new initiatives, will make Cognex far less dependent on the vagaries of the semiconductor and electronics capital equipment industries.”

Dr. Shillman continued, “And, although our net income is not yet at our target level of 20% (or more) of revenue, given the downturn in the Semi/Electronics business, we did pretty well in 2005, with net income at 16% of revenue and operating income at 20% of revenue (or 18% and 22%, respectively, excluding $3 million of amortization for DVT acquisition-related costs).”

“Finally, we had a positive surprise at the end of 2005 when the Lemelson Partnership, whose machine vision patents were declared invalid, unenforceable, and not infringed by Cognex, said that they would not seek further review by the U.S. Supreme Court of that decision (even though they have until late February of 2006 to do so), and they advised the U.S. District Court of Arizona that they intend to file a motion to dismiss their machine vision patent claims against hundreds of companies, many of whom are Cognex customers. As a result, in the fourth quarter we reversed a $1 million reserve that we had established for possible indemnification of our customers around the world. Now everyone can benefit from the use of Cognex products without fear of Lemelson,” concluded Dr. Shillman.